Random Thoughts: Is U.S Cannabis a Value Trap?

We took a walk on the wild side to ask ourselves some difficult questions.

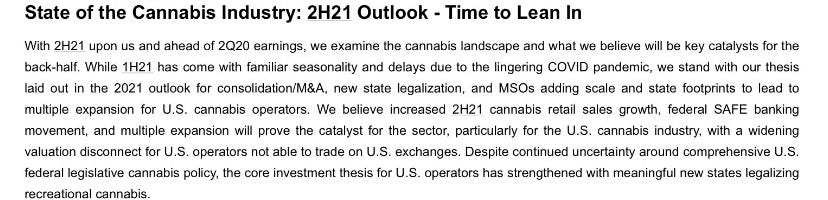

When we last spoke, way back a week ago, we were still absorbing how the street was digesting Chuck Schumer’s “shoot for the stars and moon but land on our feet” canna plan which by our lens, was everything we wanted and more, not that we were looking.

And with several U.S cannabis leaders, including U.S canna ETF $MSOS, under their respective 200-day moving averages, we were all-too-aware that losing the technical metric was no bueno in the near-term. In fact, we went so far as to map the bear case for those who don’t spend the better part of their days staring at this space.

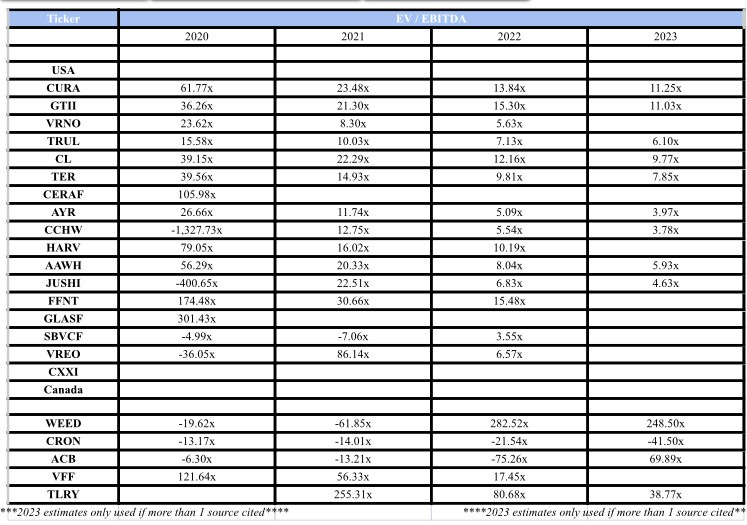

We’ve been steadfast in our view that U.S canna horses ain’t going back to their barns as we lean against continued state-level adoption and incremental federal policy to drive our base case bull thesis, a fact that is easily painted by numbers…

…and while context is always important, if not instructive…

…the f*ckery remains good and thick, not just re: custodians / clearing houses but w/r/t things we’ve seemingly left behind, particularly after $AMZN and $AAPL both opened their big cap tech arms to welcome the green machine into their worlds…

…which sorta makes me feel like we’re seeing the final / futile attempts to stifle the U.S. cannabis industry before the institutional / CPG migration / buy-build arrives.

But I’m not gonna lie: given the numbers look good, soooo good…

I found myself putting corks on my forks as I wondered: is this somehow a value trap?

Let’s think this through: the secular bear case likely involves one of several bogies:

1) Interstate commerce is inevitable and will lead to margin compression at best and massive write-downs of state-level supply chains at worst, and the current multistate operator (MSO) model will be rendered obsolete or severely impaired.

Counterpoints: Barring a surprise Supreme Court decision, interstate commerce will likely be the last domino to fall in what promises to be a prolonged, incremental and contentious end to The War on Drugs; nmw happens, states will continue to control who can grow, process or sell cannabis; we fully expect regional hubs for supply-chain redundancy / to hedge against force majeure / other disruptions; and as more states adopt, the political will to protect tax dollars / keep jobs in-state will increase in kind.

2) The FDA will overstep their regulatory boundaries with cannabis as they did with CBD, and crush the hopes and dreams of this fledgling industry.

Counterpoints: If you believe in cannabis 3.0 as we do, it’s silly to expect the FDA to just go away but we believe they’ll focus their energies on false labels / claims / steer more toward how they regulate vitamins vs. pharma [we heard an approach whereby the FDA could reactively remove specific formulations from consumer shelves once they demonstrate clinical efficacy]. A heavy FDA hand would also disadvantage small operators / social justice applicants given larger players are likely able to better absorb the cost of onerous / incremental regulations; we also don’t see broad-based criminal justice reform until / unless cannabis is removed from the CSA.

3) Proposed taxes are too high.

Counterpoints: (say it with me) this is a negotiation and Schumer’s proposed taxes were a lofty starting point that would prove too beneficial to the illicit market; insofar as we don’t believe Schumes has 50 Dem votes much less 10 GOP votes, we view this rhetoric as political posturing and continue to believe that SAFE+ will pass this Fall / Spring bc the senators from NY / NJ cannot return to their respective state-level social justice programs w/o functional banking. Scott Fortune @ Roth Capital Partners agrees:

4) Big Canna is too BIG.

Counterpoints: The reality is “Big Canna” is driving the “Big Tax Revs” and “Big Job Growth” and w/o them feeding that beast, shoveling coal into the oven, making bread while they bake bread—however you wanna put it—we’re back at square one and this is no longer the fastest growing industry in America. And while I understand / even sometimes appreciate the fact that big box CPG is currently locked out, that won’t be the case forever if our forward system is to at-all resemble capitalism.

Here’s the simple truth: while the investor in me believes this is as good as it gets for this generational opportunity—a second bite at the apple, if you will—the trader in me doesn’t like losing the technical metric one bit. We could try to massage this by noting the latest downdraft wasn’t qualified by volume but price doesn’t lie and the seasonal summer softness has some sand left in its hourglass, as long as we’re talking straight.

And while earnings are trending materially higher year-over-year (vs. what was at the time considered unsustainable COVID “pantry stuffing” level-growth) we need only to look at spending / travel trends to know a larger share of wallet has more recently been spent on things other than cannabis. They’re gonna be solid no doubt, but we view this as the mulligan quarter before 2H21 capacity ramps and the tri-state roll-out begins.

Random Thoughts

Per the recently released Harvest Health proxy statement (ahead of their merger with Trulieve), estimated combined 2022 EBITDA is > $1 billy vs. street est. ~$780 million…

…with the stock -40% vs. Feb levels / the most oversold it’s been since the March 2019 low, this is the first we’ve heard of or seen this potential disconnect.

We continue to hear that some scummers are short Verano in size into the unlock, where they hope to cover at a material discount. As discussed, $VRNOF is too cheap relative to peers that are too cheap, in large part due to shitty timing (they came public the cyclical Feb top after US canna ETF $MSOS already allocated $1 billion of capital).

Hell, if we were advising the company, we would suggest the following formula: find strong, long-term hands that like to buy growth @ value + crowd out the scummers + extend portion of the unlock = a recipe for an equity enema on good Q2 results.

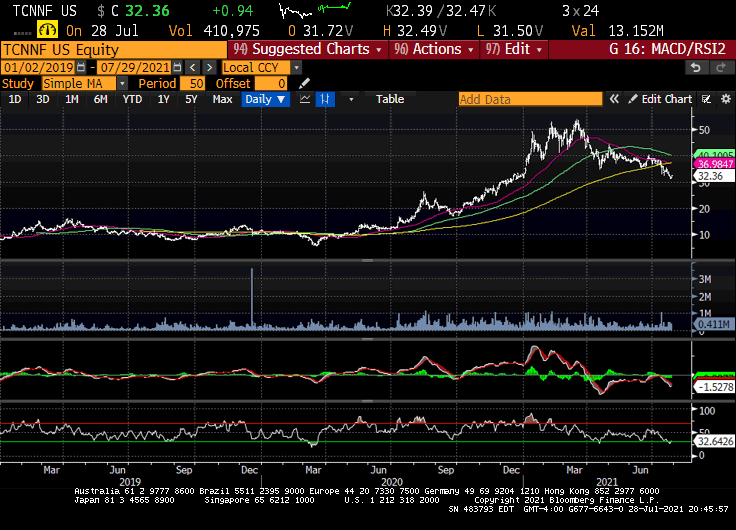

And finally, DeMark savant / Raiders fan Tommy Thornton shared this observation from his purely technical perch and while I don’t fully understand the voodoo that he do—and given I have zero idea when this pony pays off, just that it will—I pass this along without virtue or vice for as much as hope isn’t a viable investment vehicle…

…it never hurts to say a prayer.

/position in stocks mentioned

/advisor U.S cannabis ETF $MSOS